In this blog series, we're discussing how organisations can remain competitive by thinking strategically about where to use contractors in the medium-term even while running immediate cost reduction programs.

In our previous blog, we explored how long-term strategic contracting decisions develop through answering progressively tighter questions:

- For a given area, should we insource or outsource?

- For that area, which contractor (or contractors) should we use?

- For that contractor, how should we contract with them?

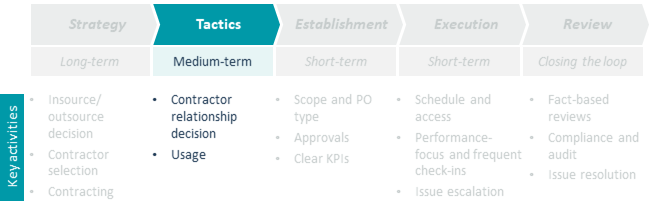

In this second blog, we explore the second component – Tactics – and how this can set us up for contractor management success.

Tactics

The key tactical decisions are relationship and usage. In other words, how we work with our contractors, and how much we work with them. Naturally there is some overlap – we’ll be inclined to use contractors we have a closer relationship with more, and we’re more likely to see our most used contractors as partners.

The tactical decisions are easier to change than the strategic ones, but we still may have to live with them for a year or two.

What type of relationship do we want with our contractors?

Almost all of our contractor relationships are transactional – we may like each other just fine, but if the market shifts for either of us, neither of us will have any hesitation in seeking something better.

But a few select contractors will be worthy of partnership. True partnership is rare but the level of trust and collaboration it brings enables valuable advantages like benefit sharing, out-of-scope continuous improvement, and perhaps the most important of all – mutual reliability.

To identify potential partners, start with categories. A few key industry/category characteristics are telling. For example, if there are only a few potential contractors it helps us to have a reliable partner.

From there, a few contractor characteristics will help identify the right potential partner if there is one. For example, a contractor offering an unusually good service could be a good partner.

The hardest and most important factor of all is trust. Like in any relationship, it doesn’t come automatically or through wishing.

Sometimes, cometh the hour cometh the partner. For example, one of our clients had to remove a contractor from a mining site for serious safety breaches in the middle of a major contract. Another contractor stepped in at short notice and completed the contract without asking for special terms or special rates. They just got on and did the job. While our client and the contractor had been consciously building their relationship, that one simple act created enormous trust and has underpinned an ongoing and fruitful partnership.

How much do we use each contractor?

Usage is primarily a tactical planning issue around volume and distribution.

Volume sounds easy (“we need this done”) but it takes careful consideration. Do we need it done now or can it wait? Would it be more efficient to bundle it with something else? Or unbundle it? Are we using a contractor just because they’re there?

In many cases we can plan our volume many months, even years, ahead. It doesn’t just help us. Certainty helps our contractors to plan. Our reliability creates their trust in us, which may lead to partnership (whether we intended it or not).

How we distribute work amongst our contractors is partly driven by strategy. If we multi-sourced to ensure ongoing competitive tension amongst our panel, then we had better make sure we give each of them a reasonable amount of work to keep them interested! That’s potentially a cost of multi-sourcing, but if we did our strategy work well then the benefits outweigh the costs.

It’s important to keep the panel honest. When we set up the contracts, we strategically included great KPIs. That means we can easily compare our contractors. We should periodically rate and rank them and distribute work subsequently according to rank.

The shovel hits the dirt

Solid Establishment lays the foundations for successful Execution before we close the loop with meaningful Review. Review outcomes feed back into strategy and tactics.

In the next part of our blog series, we'll explore the third component – Establishment.

Click through to read other blogs in this series:

Ben Thompson

Ben Thompson has 25+ years’ experience in strategy, operational improvement and line management roles. He has worked across many industries, including gambling, information technology, banking, insurance, manufacturing, education and the non-profit sector.

Linkedin