Capital projects typically do not fail for any single reason, but rather a multitude of factors. However, insufficient planning and inaccurate estimating are two of the most common culprits that lead to cost overruns and schedule delays.

Pressures to meet executive expectations around budget and timing are a leading factor in overly optimistic project plans. Using in-depth analyses that incorporate shareholder risks or other longer-term losses caused by potential delays may help secure project approval with contingency planning that meets a potential client’s appetite.

This isn’t news... capital projects are extremely complex and carry a high degree of risk. However, all too often, we see a lack of adequate risk pricing into project budgets and schedules typically driven by insufficient planning, optimism bias, and/or pressure to meet certain financial hurdles required to green light the project.

The antidote for this common problem is for project teams to effectively share a comprehensive and robust risk identification and analysis. An effective way for project leaders to accomplish this is to use a risk analysis model underpinned by a Monte Carlo simulation:

1. Risk Identification

Hold a series of risk workshops during project planning to gain a comprehensive view of potential risk scenarios from all key project stakeholders, project disciplines and project team members.

2. Qualitative Risk Analysis

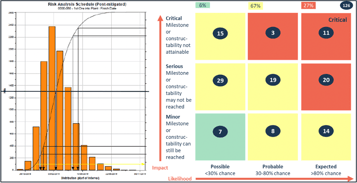

Perform a probability-impact analysis to identify the likelihood of a risk occurrence and the potential impact to cost and schedule.

3. Quantitative Risk Analysis

Complete a cost and schedule analysis that incorporates a Monte Carlo simulation1 which runs several thousand iterations of a risk model to provide a range of project costs and schedule durations aligned to the probability of each scenario.

4. Robust Risk Management

Implement a comprehensive risk management program so that risks are actively managed during project execution.

Leveraging the results of the qualitative risk analysis, the Monte Carlo simulation outputs are used to set project cost and schedule contingency allowances based on the organisation’s risk appetite. This approach allows for the contingency allowances to be adjusted for the major sources of bias typically seen in cost estimates – providing executive management with more accurate cost and schedule data and driving more informed decisions.

Leveraging the results of the qualitative risk analysis, the Monte Carlo simulation outputs are used to set project cost and schedule contingency allowances based on the organisation’s risk appetite. This approach allows for the contingency allowances to be adjusted for the major sources of bias typically seen in cost estimates – providing executive management with more accurate cost and schedule data and driving more informed decisions.

With so much on the line, it is imperative that capital project budgets and schedules incorporate all potential project costs and schedule requirements to ensure on-time/on budget delivery of major capital projects.

Better risk management will lead to more informed decision making and more efficient use of contingency allowances in capital programs, improving long term growth, sustainability and profitability.

1. Monte Carlo simulation is a computerised mathematical technique that allows people to account for risk in quantitative analysis and decision making. It shows the extreme possibilities — the outcomes of going for broke and for the most conservative decision — along with all possible consequences for middle-of-the-road decisions.

George Sawaya

George Sawaya is an expert in Partners in Performance’s Capital Practice. He has more than 15 years of experience in the engineering and construction industry focused on providing capital project consulting services. George’s experience includes working with both local and international clients on their capital projects across the disciplines of heavy industrial, commercial, and civil construction and in all phases of the project lifecycle. George holds a Master of Science in Building Construction from the Georgia Institute of Technology.

Linkedin