Think electricity pricing has been a wild ride? – Don’t expect a ‘return to normal’ any time soon

Electricity users in Australia have been exposed to a perfect storm of electricity price spikes and volatility in recent months. Price rises have been substantial, unprecedented, and disruptive to power users across multiple industries.

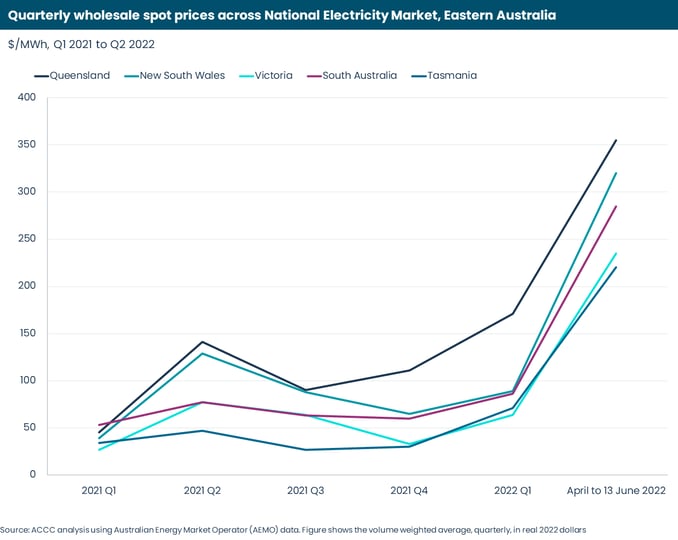

In June 2022, the volume weighted average spot price across the National Electricity Market ranged from $341 to $590/MWh – or 3.5 to 5.6 times higher than spot prices observed for Q1 2022 (graph).

And if you thought that was hard to bear, don’t relax yet. The underlying causes are structural and not going away soon. Extreme weather, lack of reliability of coal fired power stations and some of their coal mines, elevated oil and gas prices due to the Russia-Ukraine war, transmission network shortfalls, supply-demand volatility as renewable energy penetration continues its onward march – all set the stage for ongoing volatility and elevated pricing for the foreseeable future.

Furthermore, with coal-fired power stations’ supply becoming less reliable, we expect Gentailers to increase the variable portion of their prices as their fixed offers become harder to hedge with their own fossil supply. This will further increase pricing volatility.

Not surprisingly in this context, futures contract prices have risen sharply, foreshadowing prices as much as 178% higher over the next 4 years relative to March 2022 (Australian Competition and Consumer Commission, ‘Inquiry into the National Electricity Market – Addendum to the May 2022 Report’, June 2022).

Good news: you can ring-fence much of your power supply from these shocks

These structural causes are ‘outside your site fence’. But renewable power is often feasible inside (or near to) your fence, enabling you to ring-fence your power supply from much of the volatility, unreliability, and external shocks.

Industrial energy users are increasingly finding that on-site renewable power provides multiple, substantial benefits, including:

- Security of supply

- Pricing certainty

- Lower cost, even for firmed supply

With growing demands on organisations to reduce greenhouse gas emissions, embracing renewable energy also provides a leap forward on the journey to net zero emissions and demonstrates proactivity to stakeholders.

This is why, over the past 3-4 years, we have been helping our clients lock in renewable energy sources inside or close to their fence. For companies with land, buildings and space – including rooftops – the technology exists today to develop self-reliance for the bulk of your electricity needs. Steady improvement in renewable power costs, combined with avoidance of distribution and transmission charges, typically offers better economics than a blended grid.

Even if you don’t have land or space, there are opportunities to partner with aggregators or traders to buy green electricity and trade electric power in and out of the grid for economic benefit, leveraging virtual power plants or PPAs. While these options are typically more expensive than on-site solutions, they are a step in the right direction.

What does an ‘inside or close to your fence’ power solution entail?

An on-site power solution typically entails investment in a blend of renewable technologies (solar, wind, biomass, batteries). The configuration will be client-specific, but the return on investment should be attractive.

Such systems not only reduce electricity costs and secure supply; they also provide revenue generating opportunities through trading into the grid at peak times. In addition, battery storage can support grid stabilisation and frequency control or smooth out energy usage peaks, reducing grid connection charges.

Who owns and operates?

This is up to your company and will depend on your strategic and financial priorities. If you are concerned that on-site renewable power is difficult to manage, or will be a distraction from your core business, there are options where a third party can develop, own and operate your on-site power on your behalf. All you do is receive the power and reap the economic benefits. Such options are typically called BOOT (build, own, operate, transfer) arrangements.

We are helping clients with a full range of outcomes – many choose to go with ‘business as usual’, with electricity supplied on a $ per firmed MWh just as they do today. Others see electricity becoming a core part of their business; in these cases, we help them through the process of design and implementation right through to the assurance of stable operations.

The time to act is now

Time is of the essence. The risks of high electricity prices and energy-based disruption are not going away soon. Companies need to reduce dependence on a grid with mixed reliability and volatile pricing, and they need to reduce greenhouse gas emissions. There are substantial economic and competitive benefits in moving quickly to self-reliance for the bulk of your electricity needs through renewable power solutions inside or close to your fence.

Skipp Williamson

Founder and Managing Director

Julian McCarthy

Director Energy Transition, Australia